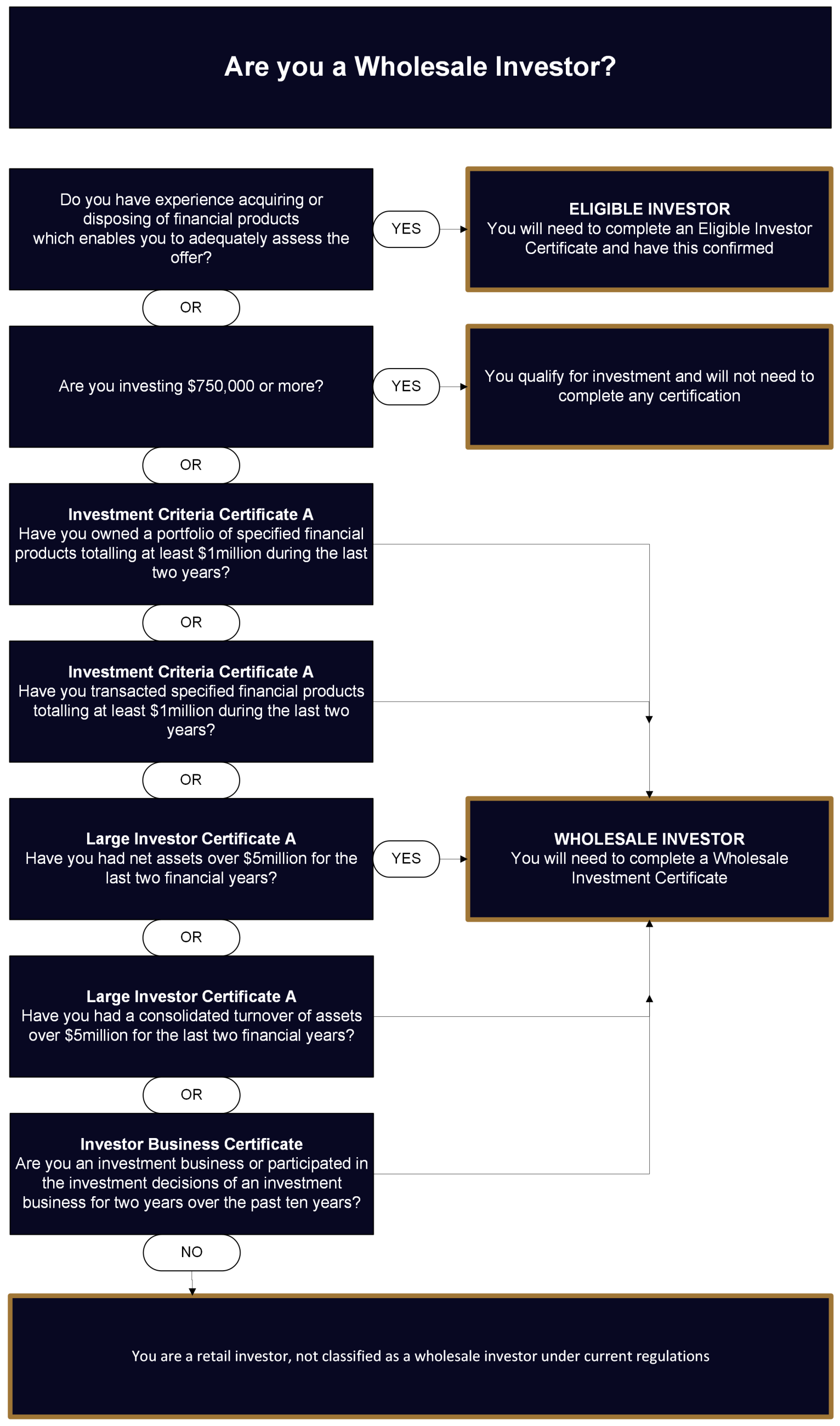

What is a Wholesale Investor?

07.10.2024

What is a Wholesale Investor

Wholesale investment opportunities can be tempting, often offering the potential for higher returns. However, unlike retail investment offers, they come with fewer safeguards. These types of offers are usually directed at well-seasoned investors, those with substantial capital to invest. If you're not highly experienced, it’s essential to exercise caution and seek guidance from a financial adviser before diving into wholesale investment offers.

Additional information regarding the risks of wholesale investing can be found on the FMA website.

THE FOLLOWING IS GENERAL IN NATURE AND SHOULD NOT BE CONSIDERED A COMPREHENSIVE GUIDE. IF YOU HAVE ANY DOUBTS, YOU SHOULD CONSULT YOUR FINANICAL ADVISER OR LAWYER BEFORE MAKING ANY INVESTMENT DECISION.

Who Qualifies as a Wholesale Investor?

A wholesale investor is defined by law as someone or an organisation with enough previous investing experience that they don’t require the same level of disclosure that retail investors do. Wholesale investors can either qualify for all types of financial product offers or only for specific ones.

Wholesale Investors for All Financial Product Offers

You’ll be classified as a wholesale investor for all offers of financial products if:

· You run an investment business (for example, a company mainly involved in investing, a registered bank, or a financial adviser)

· You meet the investment activity criteria, meaning you regularly invest and understand the risks involved

· You are a large entity, with net assets or earnings exceeding $5 million for each of the last two financial years

· You are a government agency

You meet the investment activity criteria if:

· You (or any entities you control) currently own or have owned within the past two years, a portfolio of financial products with a total value of at least $1 million

· You (or any entities you control) have, within the past two years, executed transactions to acquire financial products where the total amount payable was at least $1 million

· In the past 10 years, you have been employed or participated in an investment business and, for at least two years within that period, have played a significant role in the investment decisions of the business

Wholesale Investors for a Particular Offer

In certain situations, you may only be classified as a wholesale investor for a specific investment opportunity. You qualify if:

· You are an eligible investor for that offer (explained below)

· The minimum investment you are required to make is $750,000, or your cumulative investments with the provider equal at least this amount

· You're part of a bona fide underwriting agreement, which typically applies to investment banks or similar institutions

· The notional value of a derivative investment in the offer is at least $5 million

What is an Eligible Investor?

An eligible investor is a specific type of wholesale investor who can self-certify that they have sufficient experience in acquiring or disposing of financial products. This experience should allow them to assess:

· The merits of the transaction

· Their own information needs related to the transaction

· Whether the information provided by the offeror is adequate

To self-certify, you need a financial adviser, qualified statutory accountant, or lawyer to sign off that you have been advised on the consequences of certifying yourself and that there are no doubts regarding your ability to do so.

In certain circumstances Investors who have had an annual gross income of at least $200,000 for each of their two most recent income years, do not need a financial adviser, qualified statutory accountant or lawyer to certify the investor’s income. A company relying on this small offers exclusion must provide each investor with a warning statement in the form prescribed in the FMCA regulations which warns that the full disclosure obligations do not apply to the offer, and that the investor will have fewer legal protections for their investment.

The Lack of Protections for Wholesale Investors

It’s important for prospective investors to understand that wholesale investors do not enjoy the same level of protection as retail investors. While the FMA could potentially intervene in retail offers, its oversight of wholesale offers is much more limited. If you’re investing in a wholesale offer, you may miss out on the following:

· You won’t receive a Product Disclosure Statement (PDS), which normally outlines the risks, features, and benefits of an investment in straightforward language

· You may be dealing with a firm that is not licensed by the FMA, especially in areas like managed investments and derivatives

· If things go wrong, you may not have access to a free independent dispute resolution scheme

· You won’t be guaranteed to receive regular updates on your investment’s ongoing performance

· For certain products, like debt securities, you may not have a licensed supervisor to manage your interests.

As noted above you may have fewer legal protections for your investment.

Fair Dealing Still Applies

Despite the reduced protections, offerors must still follow fair dealing requirements. They are prohibited from:

· Engaging in misleading or deceptive conduct

· Making false or misleading statements in their offer documents or advertisements

· Making unsupported representations

So, while wholesale investments offer different opportunities, they come with increased risks. Being classified as a wholesale or eligible investor means you’re expected to understand these risks and take responsibility for your decisions. If you’re unsure you can contact us at info@armillary.co.nz.

Have a look at our flowchart below to see if you qualify as a wholesale investor.

THE FLOWCHART IS GENERAL IN NATURE AND SHOULD NOT BE CONSIDERED A COMPREHENSIVE GUIDE. IF YOU HAVE ANY DOUBTS, YOU SHOULD CONSULT YOUR FINANICAL ADVISER OR LAWYER BEFORE MAKING ANY INVESTMENT DECISION.